SushiTech Tokyo Booms Globally While Energy Companies Retreat from Hydrogen to LNG

While SushiTech Tokyo showcases innovation with 657 global startups, Nissan announces 15% workforce cuts. 🎧AI-powered audio version is available in English and Japanese!

*Editor’s note: This article was originally published on 5/14/2025 on Linkedin.

Welcome! I'm Hiroyasu Ichikawa, ichi, and this is issue 152 of the "Japan Climate Curation" newsletter📬, which has been curating hand-picked Japan-related climate news content every week since spring 2022, with over 450 subscribers [ more than 2,820 on Linedin]. You can subscribe by clicking on the Linkedin page or the form below.

I hope you find the articles below beneficial for reading (or skimming)!

Found this week's news insights valuable? Please give it a quick "like" or "share" on LinkedIn – you never know who else in your network might benefit from staying in the loop on Japan's climate scene🙂🙇

🎧🗣️Audio Version of this newsletter, thanks to NotebookLM,

In English🇺🇲: Japan Climate Curation vol. 152 [15:12 min.]

In Japanese🇯🇵: Japan Climate Curation vol. 152 [6:18 min.]

【Digest of this week's topics】

This week highlights Japan's contrasting paths in sustainability. While SushiTech Tokyo showcases innovation with 657 global startups, Nissan announces 15% workforce cuts as Trump's tariffs add financial pressure. Both Nissan and Toyota have canceled EV battery plants, weakening Japan's position against Chinese competitors. Japan's climate policy faces criticism from young experts advocating for more ambitious targets than the government's 60% emissions reduction by 2035. Meanwhile, energy companies like Eneos are increasing LNG investments while reducing hydrogen development, as the country introduces carbon pricing while reluctantly considering Trump's Alaska LNG project demands.

*Disclaimer: Generative AI tools such as Claude Sonet 3.7 and NotebookLM have been used for summary and translation assistance. 🙂

[🇯🇵📰👀Japan Climate News Headlines]

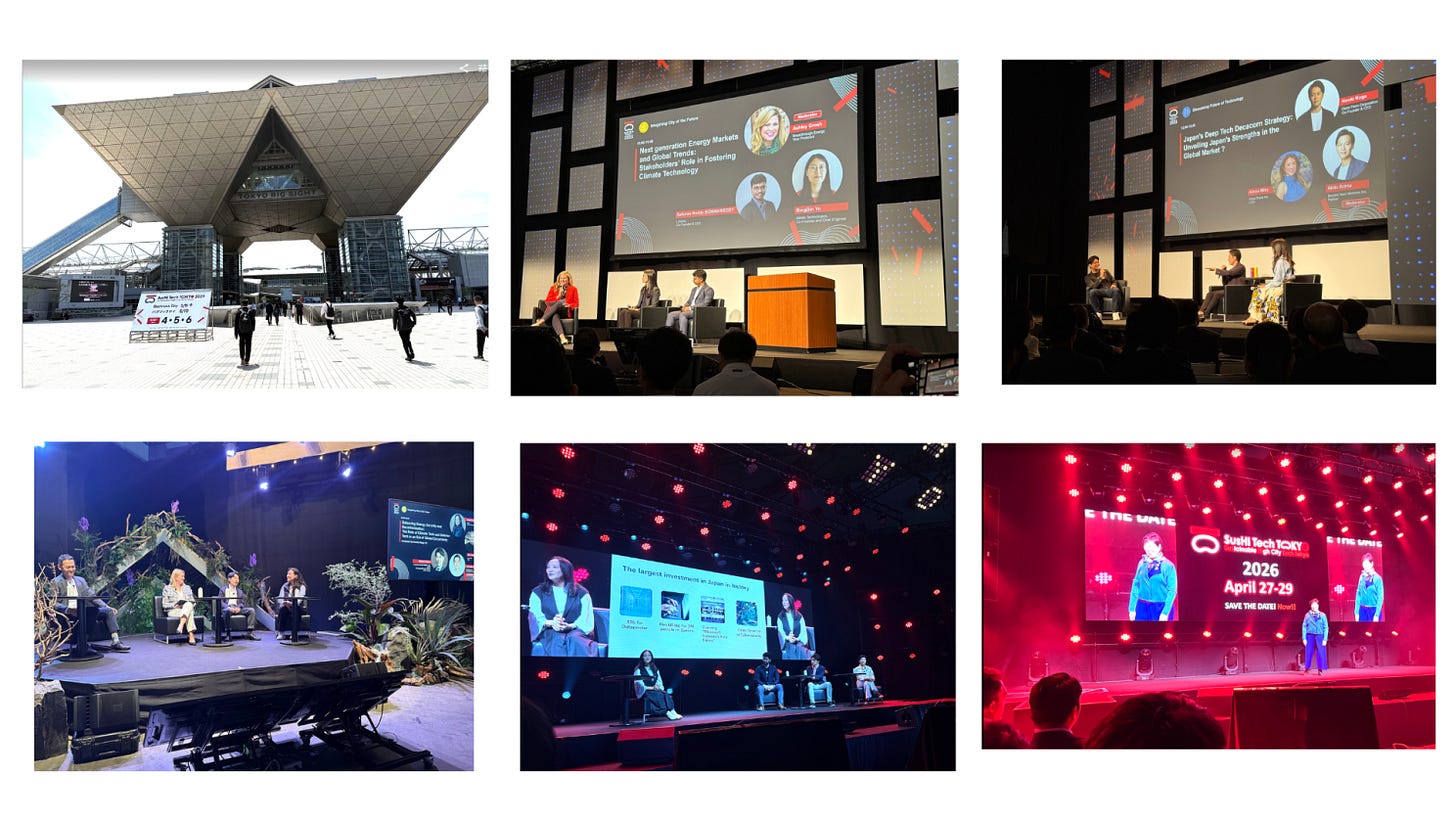

【1】Report on SusHi Tech Tokyo 2025 (May 8-9, Business Days) Participation

I attended SusHi Tech Tokyo 2025 at Tokyo Big Sight, where startups, major corporations, and investors from Japan and abroad gathered for this event. This was the third edition of the conference (initially launched as "City Tech Tokyo" in 2023 [my report back then]), and it has grown impressively, with participating startups increasing by 40% to 617 companies compared to last year, with approximately 60% coming from overseas. *2024 report

Global Presence and Atmosphere

What struck me most was the strong international presence. Reflecting the 60% proportion of foreign companies, about 70-80% of pitch events and panel discussions were conducted in English, and simultaneous interpretation was provided. This made the event feel distinctly more international than previous years, though it meant I encountered fewer domestic industry contacts and acquaintances than before.

This situation highlighted the growing importance of communicating effectively in English for Japanese startups and businesses. Three years ago, I started this English newsletter, "Japan Climate Curation," focusing on Japan's climate change initiatives and climate tech startups. This experience has shown me that foreign investors and companies are genuinely interested in Japan's excellent technologies and initiatives. Particularly since the recent Trump administration transition, I sense increased expectations from the US, European, and Asian countries regarding Japan's technological capabilities and corporate resources.

Key Focus Areas

The main themes receiving attention at this year's event were AI, quantum computing, and food tech. Many countries set up booths to showcase their startups. I found climate tech sessions somewhat limited, though there were presentations on decarbonization, circular economy, and energy security. A particularly informative "Balancing Energy Security and Decarbonization" session revealed how Europe's focus has shifted toward defense technology while climate tech has become less prominent. Other emerging keywords that seem to be "rebranding" climate tech include "resilience," "global supply chain," "energy security," and "deep tech."

Tokyo's presence in the global startup ecosystem is strengthening, and next year's event is scheduled for April 27-29, 2026. I plan to attend again next year🙂🤞.

*🚀 Sushi Tech Tokyo 2025 kicks off with bigger global presence [05/08 JStories]

【2】🚗 Nissan to cut 15% of global jobs and almost halve number of plants [05/13 Financial Times]

Nissan has announced plans to cut 20,000 jobs, representing 15% of its global workforce, and reduce its factories from 17 to 10. President Trump's tariffs have added urgency to the company's survival crisis. The company reported a loss of ¥670 billion for the fiscal year ending March, compared to a ¥426 billion profit in the previous period. CEO Ivan Espinosa called the results a "wake-up call" and stated these measures were "necessary for survival." The US tariffs will add ¥450 billion in costs this fiscal year, with Nissan expecting to offset about 30% through various measures. The company plans to reduce annual production capacity to 2.5 million units by 2027. Regarding its UK plant in Sunderland, Nissan aims to produce more electric vehicles there in partnership with Renault. The company is also exploring partnerships with Mitsubishi Motors and Honda to utilize spare capacity at its US factories.

【3】🔋 Nissan, Toyota battery plant U-turns stall Japan supply chain goals [05/11 Nikkei Asia]

Following Toyota, Nissan has also canceled its domestic EV battery plant plan, dealing a blow to Japan's battery supply chain goals. Nissan abandoned its 153.3 billion yen investment due to poor earnings. As achieving METI's target of 150 GWh domestic battery production capacity by 2030 becomes more challenging, Japan's once-leading battery industry now significantly lags behind Chinese companies that dominate the global market.

【4】🌍 A 26-Year-Old Asked to Help Shape Japan's Climate Goals Has a Warning [5/9 Bloomberg Green]

Shota Ikeda, the 26-year-old president of Hachidori Solar, has gained attention for his criticism of Japan's climate policies. While the government approved a 60% emissions reduction target by 2035 from 2013 levels, Ikeda advocated for at least 75%. As a member of the expert committee, he criticized the lack of transparency and genuine debate in the policy-making process, emphasizing the importance of continued advocacy for younger generations. Climate advocates point out that Japan's target is not aligned with the global 1.5°C goal and criticize both the overreliance on nuclear power and the unfair consultation process.

【5】📊 Japan Policy Briefing: 7th Strategic Energy Plan, Climate Plan/NDC, GX 2040 Vision (Feb 26, 2025) [05/13 Climate Integrate]

Japan's Seventh Strategic Energy Plan, Climate Plan, and GX2040 Vision, approved by the Cabinet in February 2024, outline the nation's energy and climate policy direction. The Energy Plan anticipates increased electricity demand, targeting a 2040 power mix of 40-50% renewables, 30-40% thermal, and 20% nuclear. The Climate Plan sets GHG reduction targets of 60% by 2035 and 73% by 2040 (compared to 2013). The GX Vision emphasizes industrial competitiveness and economic growth, with concrete carbon pricing mechanisms. However, challenges remain, including slow renewable energy adoption, continued fossil fuel dependence, and unclear decarbonization roadmaps.

【6】♻️ Japan's Decarbonisation Strategy - Walter James [05/08 IR thinker]

Japan's energy supply remains dominated by fossil fuels (coal 26%, oil 38%, natural gas 21%) while working toward decarbonization. According to Dr. Walter James, there is strong skepticism about achieving Japan's targets of a 46% reduction by 2030 and a 76% reduction by 2050. LNG is emphasized as a "transition fuel," with Japan aiming to become Asia's LNG hub. The hydrogen society vision primarily aims to enhance industrial competitiveness, though cost reduction for low-carbon hydrogen remains challenging. Nuclear restarts are progressing with increased public support, but local safety concerns persist. Renewable energy targets of 40-50% by 2040 face geographical constraints and a lack of a manufacturing base. Government-industry relations are close, while civil society protests are minimal.

【7】⛽ [Opinion] Japan must resist Trump's Alaska LNG pet project [05/12 Nikkei Asia]

The Trump administration demands Japan invest in the $44 billion Alaska LNG project in exchange for tariff relief, but the authors argue that Japan should refuse. According to Tokyo Gas's CEO, the project won't operate until 2030 and will cost twice as much as conventional LNG. Yielding to these demands would lock Japan into expensive long-term contracts, sacrificing energy independence. The International Energy Agency states that new LNG investments are incompatible with climate goals. The authors urge Japan's government to demonstrate leadership by investing in a sustainable future instead.

【8】🏭 Japan's steelmakers aiming to spread use of 'green steel' [05/09 NHK World]

Japanese steelmakers promote "green steel," which generates lower carbon dioxide emissions than conventional steel. Methods include using electric furnaces instead of coal-burning ones, though production costs are higher due to the required new investments. JFE Steel, Nippon Steel, and Kobe Steel supply this material to shipbuilders, automakers, and construction companies. The Japanese government is encouraging its use by including it in the subsidy assessment standards. Manufacturers are also developing hydrogen-powered blast furnaces to reduce emissions, though practical implementation remains distant. The key challenge is gaining public acceptance for the higher prices needed to cover production costs.

【9】⛽ Japan's Eneos to ramp up investment in LNG, SAF while slowing hydrogen [05/12 Reuters]

Japan's largest oil refiner, Eneos Holdings, announced plans to increase investments in low-carbon energy such as LNG and sustainable aviation fuel while slowing down investments in cleaner alternatives like hydrogen. Under its new three-year plan through March 2028, Eneos will invest 1.56 trillion yen, including 740 billion yen for low-carbon and decarbonized energy. CEO Tomohide Miyata stated they will "reinforce LNG operations" as demand is expected to grow until around 2040.

【10】💰 Japan's Carbon Pricing [05/09 The Institute of Energy Economics]

This episode is talking about "Japan's Carbon Pricing". The Japanese Government submitted the bill earlier this year to introduce an ETS (Emissions Trading System) to its Diet. The ETS will mark a significant step in introducing carbon pricing in Japan. Mr. Terazawa will explain the design of the Japanese ETS.

📬That's all for this week! Thank you for reading(or skimming) 🙇. I hope you will have a wonderful week ahead!

Did you found this week's news insights valuable? Please give it a quick "like" or "share" on LinkedIn – you never know who else in your network might benefit from staying in the loop on Japan's climate scene🙂🙇

The "Climate Curation" newsletter in 🇯🇵Japanese (every Saturday) is available on Linkedin and theLetter.

Please feel free to contact me via email: hiroyasu.ichikawa [@]socialcompany.org, if you have any research/consulting needs for your business or just for a coffee chat☕.

My personal Twitter(X) account (in 🇯🇵Japanese) @SocialCompany

BlueSky account(English): socialcompany.bsky.social]

ichi (Hiroyasu Ichikawa)